15109 votes - Finance - First release: 2015-08-21T05:13:49Z

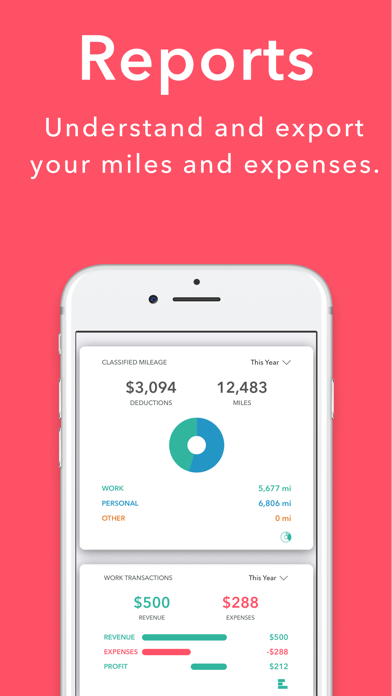

Screenshots

Description - 4+

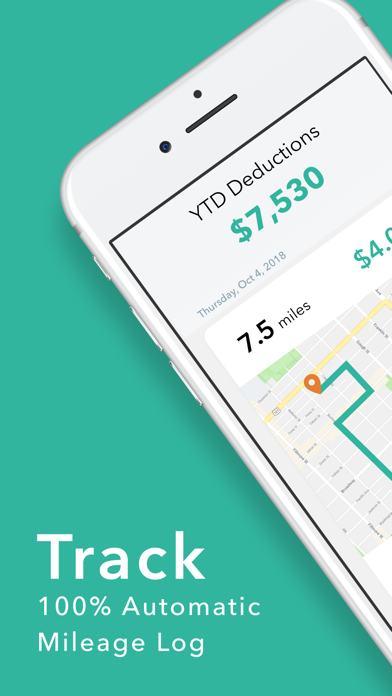

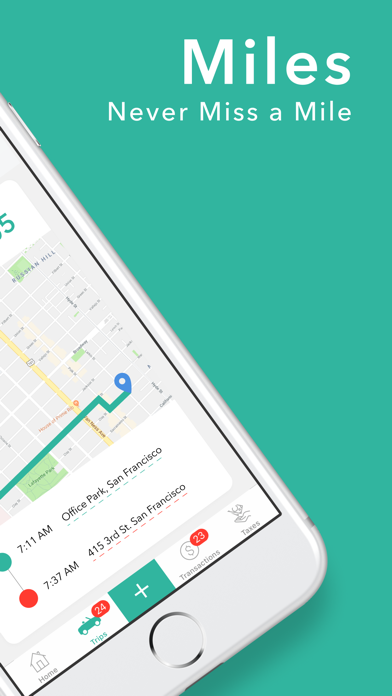

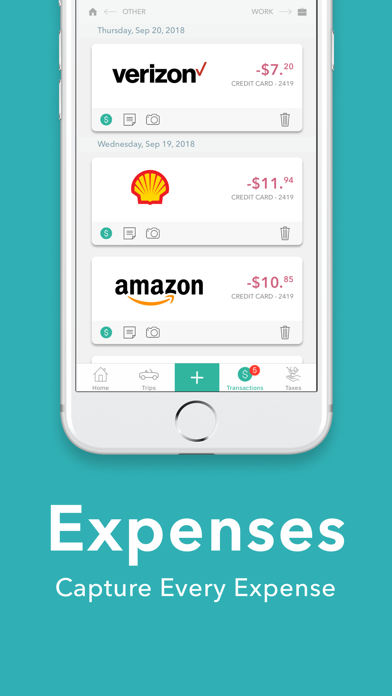

1,000,000+ people trust Everlance to track their mileage and expenses automatically. Everlance uses GPS to create an IRS compliant mileage log and connects with your bank or credit card to sync with your expenses & receipts. • Self-employed users find an average of $7,500 a year in potential tax savings. • Employees save hours of valuable time and frustration with Everlance magically recording mileage & expenses for them.. ◆ MILEAGE TRACKING THAT JUST WORKS ◆ Everlance replaces the paper mileage log and shoebox of receipts used by so many. The app automatically tracks your mileage and other business related expenses using the GPS of your phone. 2020 IRS standard mileage rate: • Business mileage: 57.5 cents per mile • Medical mileage: 17 cents per mile • Charitable mileage: 14 cents per mile This means that every 1,000 miles is worth $575 as a business expense you don't have to pay taxes on. ◆ RECEIPTS & EXPENSES ◆ • No more shoebox of receipts! Connect your personal or business credit cards and upload receipts directly into the app. • Securely store receipts in the cloud • Keep accurate business or personal expense records ◆ DETAILED MILEAGE & EXPENSE REPORTING ◆ • Export IRS-compliant mileage and expense reports from the cloud. • Easily filter mileage by classification type (work, personal, etc.) location, or many other categories from the app or from your personalized online dashboard • Customize mileage and expense reports in PDF, CSV, or Excel formats ◆ FEATURES ◆ • Detect and log all of your miles automatically (or try adding TO and FROM locations and watch the app magically fill in the rest of the mileage) • Instant Deduction Finder - Connect your credit card & find $1,000's in tax deductions in seconds. • Quickly categorize all of your Self-Employed business expenses • Calculate mileage, trip start time, end time, and reimbursement value per mile • Swipe to categorize mileage as business, personal, charity, or medical • Save your frequent trips addresses and to save time entering in past mileage • Bank and credit card integration to track revenue and credit card expenses • Automation features like Work Hours, Favorite Places, and Favorite Trips • Supports multiple vehicles and businesses ◆ PERFECT FOR◆ • On-demand: Uber, Lyft, Doordash, Postmates, Instacart, all gig & delivery... • Real Estate: Realtors, Broker, Property Managers, Investors, etc. • Companies: sales, consultants, construction, etc. • Mobile workforce ◆ TAX VAULT - AUTOMATICALLY SAVE FOR TAXES ◆ Rest easy knowing you saved enough for taxes. • We got you. We’ll recommend how much to save for taxes. • You’re in control. Securely withdraw funds anytime. • Free for 2020. Build financial security, on us. ◆ EVERLANCE PREMIUM ◆ The standard Everlance account is 100% free, but many users choose to upgrade to Premium. All accounts will start with on the free Everlance Plan. Start a 7 day free premium trial when upgrading to Everlance Premium (hassle free, cancel anytime). Everlance Premium allows you to unlock Unlimited Mileage Tracking, Advanced PDF Reports, Premium Support and more for $7.99/month recurring or $59.99/year recurring for the annual plan. We'd love to hear from you! Feedback or ideas are welcome. Email: [email protected] Learn More: Terms of Service: https://everlance.com/terms-of-service Privacy Policy: https://everlance.com/privacy Subscription Details: • Subscription automatically renews unless auto-renew is turned off at least 24-hours before the end of the current period. • Account will be charged for renewal within 24-hours prior to the end of the current period, and identify the cost of the renewal. • Subscriptions may be managed by the user and auto-renewal may be turned off by going to the user's Account Settings after purchase. • Any unused portion of a free trial period, if offered, will be forfeited when the user purchases a subscription to that publication, where applicable.