1502 votes - Finance - First release: 2020-12-09T08:00:00Z

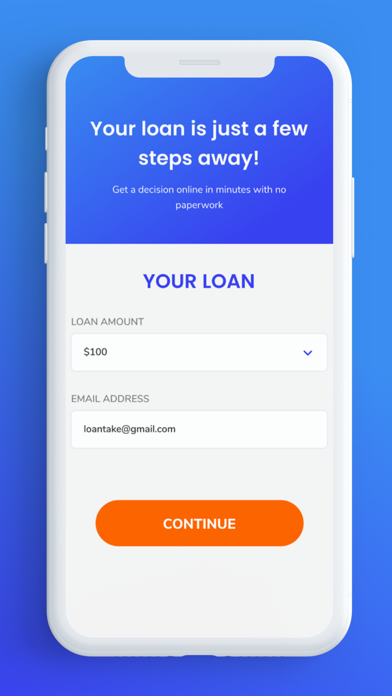

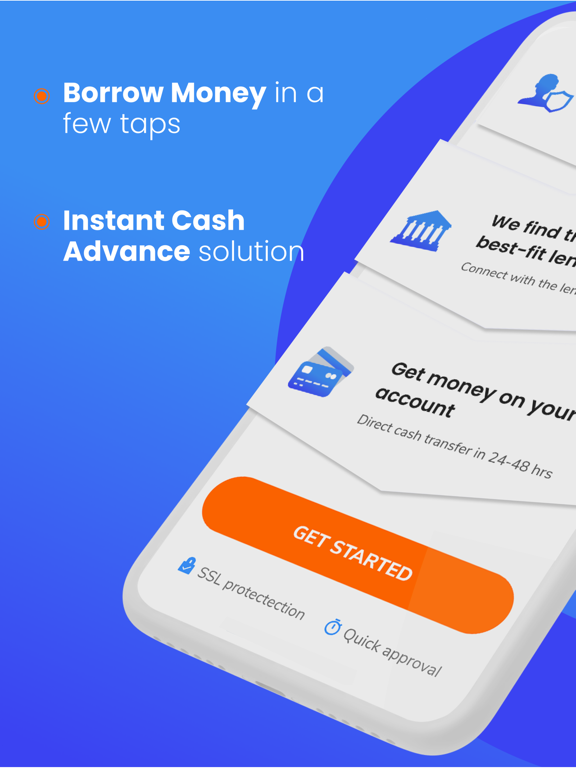

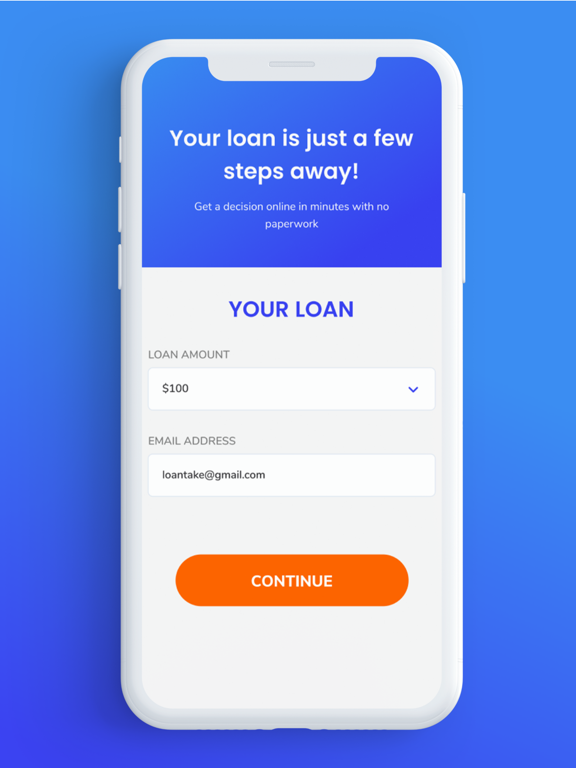

Screenshots

Description - 4+

Whenever you need to borrow money, our payday advance loan app can be always by hand. Install it once and get a great chance to acquire financing help even on the go. Our cash advance app is your trusted guide to reliable pay day loan lenders that can help you out if you need money now and here. Apply for payday loans in a few taps when you have our money loan app installed on your iPhone. Take advantage of the simple, fast, and safe application. If quick cash help is what you are seeking at the moment, our app is your best choice! No more googling for “instant cash advance” options and tedious web surfing that takes much time and effort. Have a chance to apply for a payday loan and get the needed money asap. The speedy and paperless application process helps to solve your short term money troubles on the go. Money borrowing can be easy and fast because the solution can be right in your pocket. Get our app installed on your iPhone and take advantage of its convenience any time you need a paycheck advance. You’ll never know until you try, right? Instant loan processing and a wide network of lenders help you get the money now and here. Get a loan with the help of our speedy cash app is a great way to save time! It’s convenient, quick, and always by hand. Material Disclosure: The PaydaySay app is not a lender, but a connecting service cooperating with the network of direct lending services. This app doesn’t charge any fees from the customers for connecting them with the lenders. By submitting your information in this app, you agree to let the participating lenders verify your details. You are not obliged to use this service, apply for any credit options, or accept any offers. The residents of certain states may not be eligible to get loans. The minimum and maximum periods for small loan repayment are typically from 65 days up to 2 years. The terms differ depending on the money lender you get connected with. APR (Annual Percentage Rate) is the annualized interest rate charged when you request money in advance. It combines the nominal interest rate and some fees or additional costs that can be involved when you get a loan. The APR on quick loan options varies, with many lenders in the network offering rates of 5.99% to 35.99% on unsecured personal loans for borrowers with a good credit score. The Payday Say money advance app is not involved in the lending process, thus we can’t state any specific APR you will be offered applying for a fast cash loan today. The credit decisions and terms depend solely on the lender, based on your credit score, income, credit history, and other factors. The lender is legally required to inform you of the APR and other loan terms before executing the agreement. Some states have strict laws limiting the APR rates and fees that a lender can charge you. Only the lender you are connected with can inform you of specific rates and terms in accordance with the local laws. A representative example of the total loan cost (all applicable fees are included): Loan amount - $2,500; loan term - 12 months; APR - 10%; fee - 3% Your monthly repayment is $219,79. The total amount payable is $2,637. The total interest is $137,48. Quick loans can help you solve emergency expenses, pay unforeseen bills, cover urgent costs, or just get a few hundred bucks to make ends meet until payday. No matter what your reason, be responsible and attentive applying for any financial option, even if it’s just a small loan. Apply today and get money fast!