327 votes - Finance - First release: 2020-09-28T07:00:00Z

Screenshots

Description - 4+

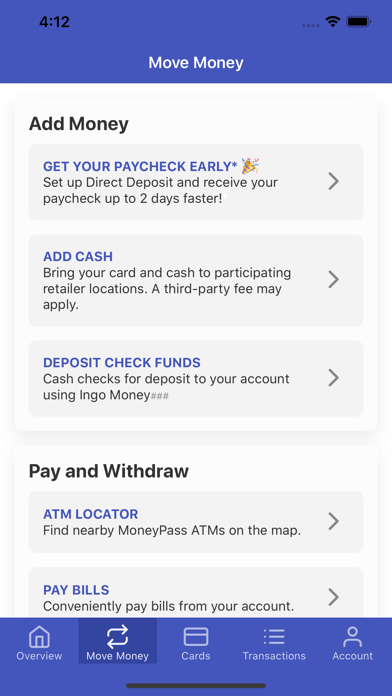

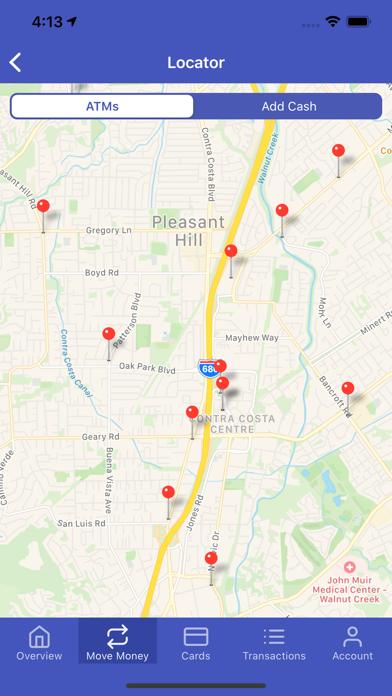

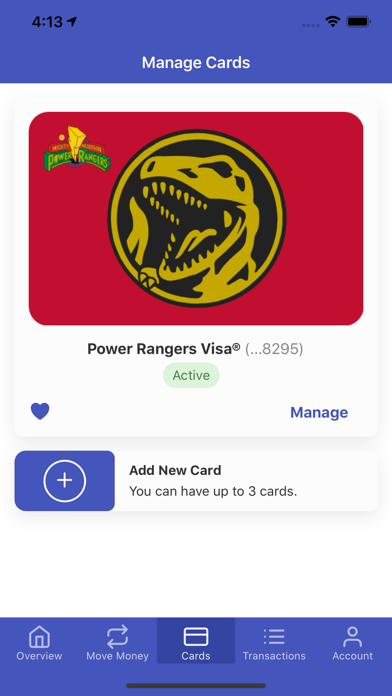

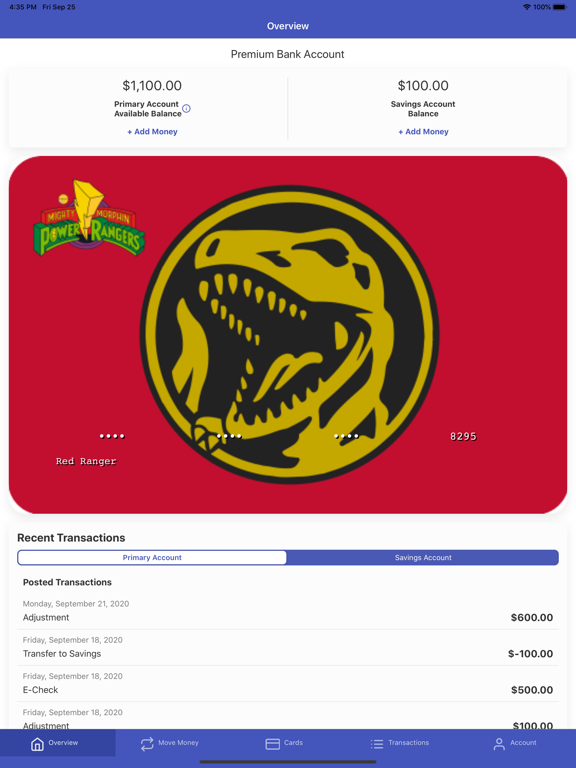

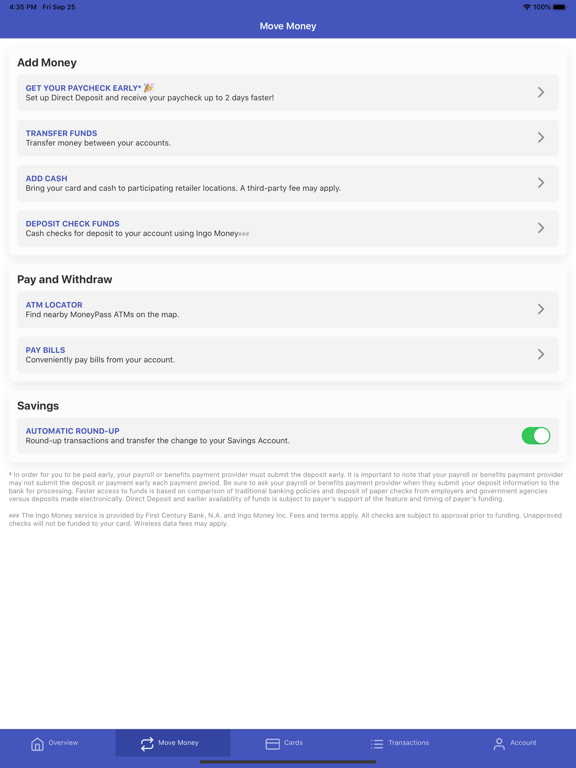

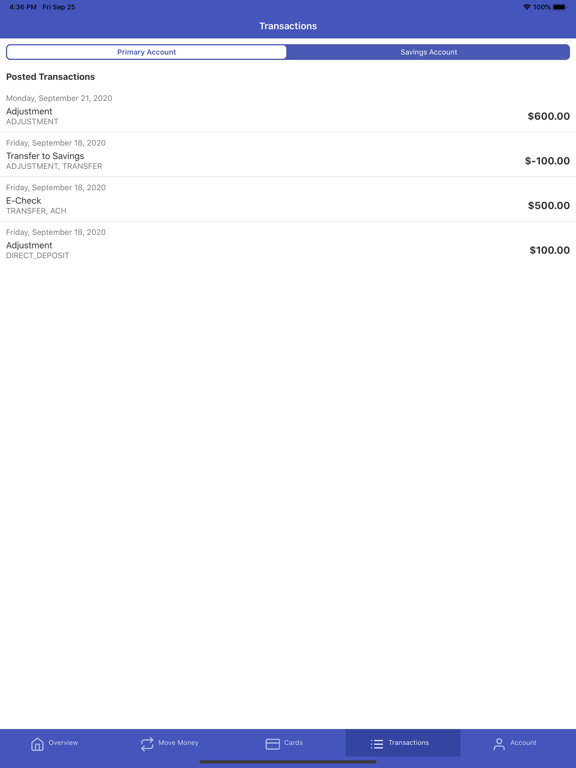

Everything you need to manage your CARD Premium Bank Account by MetaBank can be found in our convenient mobile app! In our Premium Banking app, you can sign up for an account, check your balance and transactions, open an Optional Savings Account, sign up for optional Overdraft Protection, locate fee-free MoneyPass® ATMs, get instructions on how to get paid up to 2 days faster using QuickPay Direct Deposit, and more. Don't have a Premium Bank Account with us yet? Choose from thousands of card designs in the app and sign up for one that matches your personality. You can use your account and card everywhere Visa® debit cards are accepted. Download the Premium Banking app today, and manage your finances in a flash. The CARD Premium Bank Account is a deposit checking account established by MetaBank, N.A., Member FDIC.