4755 votes - Finance - First release: 2020-03-25T07:00:00Z

Screenshots

Description - 4+

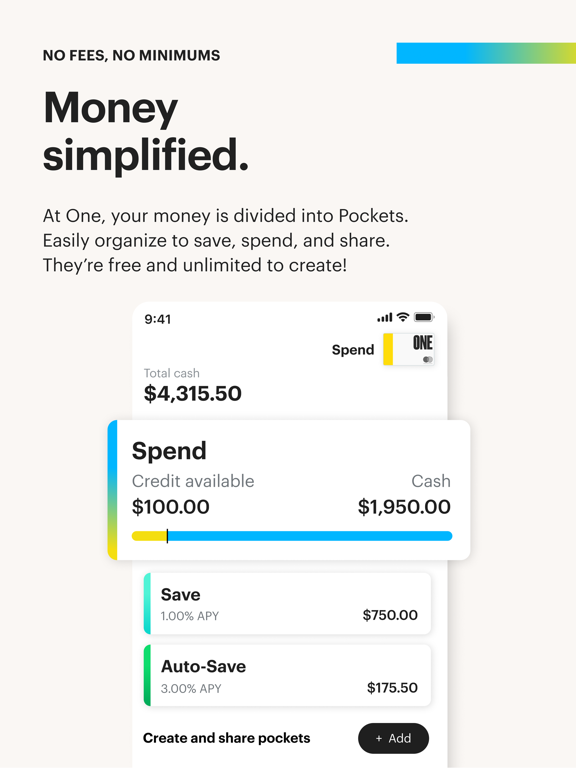

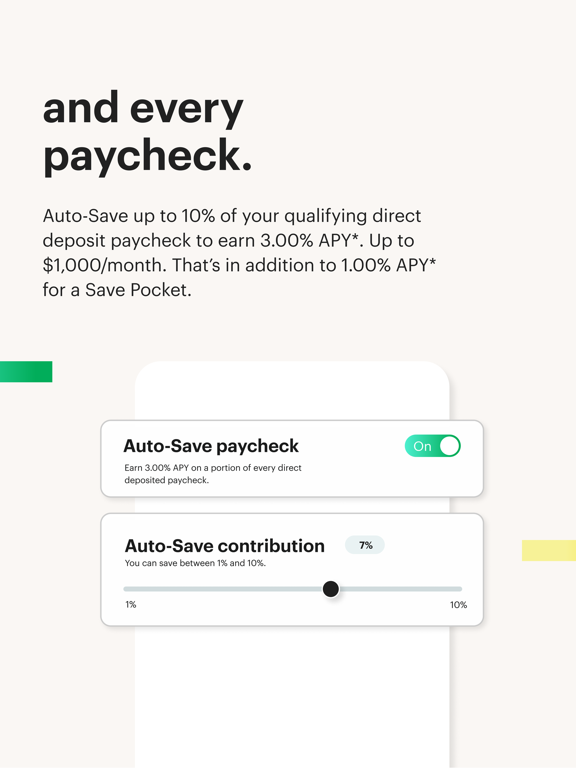

Your financial well-being is the goal and we can help get you there: • Get paid early • Bank with no fees and no minimums • Auto-Save at 3.00% APY* Traditional banks are charging fees to store and use your own money. At One, you can easily spend, save, and share from a single account—for free! All-in-one banking that can help you build a solid foundation. • One card • One app • One account Every One account can... • Bank with no fees and no minimums. • Earn 1.00% APY* – up to $5,000 in Save Pocket. • Earn unlimited 3.00% APY* on One card round ups with card Auto-Save. • Create and share unlimited free Pockets. • Access 55,000 fee-free Allpoint ATMs. • Pay anyone with free ACH bank transfers. • Activate a no-fee approved Credit Line. • Access helpful budgeting tools and features. Add paycheck direct deposit to unlock… • Getting paid up to 2 days early with Early Paycheck. • 3.00% APY* on up to 10% of your paycheck direct deposit (up to $1,000/month). • Increased savings potential to $25,000 in Save Pocket at 1.00% APY*. • Increased Credit Line (subject to approval). Every One account has a Spend Pocket, Save Pocket, and Auto-Save Pocket to help you on your financial journey. Customize your account with additional free Pockets! → Create a Pocket for a bill, savings goal, or to quickly budget. → Share a joint Pocket to manage money together. → Every Pocket has an individual account number so you can share with another person (or group of people) while keeping other Pockets private and secure. Organize your money, simplify your life. → Automate your budget with Scheduled Transfers. Set schedules for how much money automatically transfers in your One account. → Set up dedicated Pockets with unique virtual card numbers to organize and pay recurring bills! → Easily adjust your card spending on-the-go in the One app. Choose which Pocket to pull funds and reassign your card anytime. *Annual Percentage Yield effective as of 9/1/2020 and subject to change. 3.00% APY available on all Auto-Save balances. Maximum contributions of up to $1,000 per month for paycheck Auto-Save and no maximum contribution for card Auto-Save. 1.00% APY available on Save balances up to $5,000, up to $25,000 with a qualifying paycheck direct deposit. Early Paycheck may post up to 2 days earlier than the scheduled payment date. Early direct deposit of a paycheck depends on factors such as timing of the payer’s deposit transmission, and the type of payer transmitting the deposit. Learn more about what qualifies as a paycheck direct deposit at bankwith.one/directdeposit. Your One account is FDIC-insured through our bank partner, Coastal Community Bank, Member FDIC. The One card is issued by Coastal Community Bank, Member FDIC, pursuant to license by Mastercard International. ©2017-2021 and TM, NerdWallet, Inc. All Rights Reserved.