1636 votes - Finance - First release: 2019-08-08T07:00:00Z

Screenshots

Description - 4+

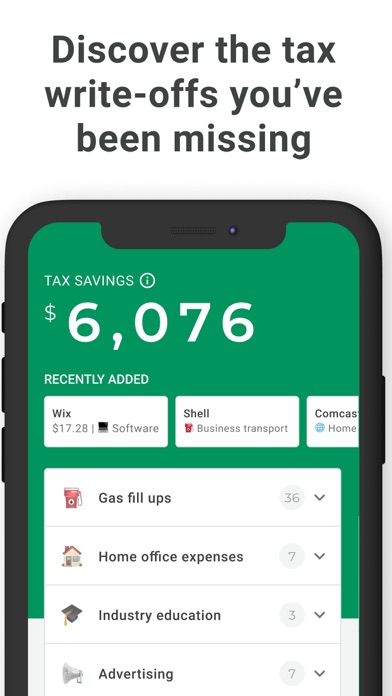

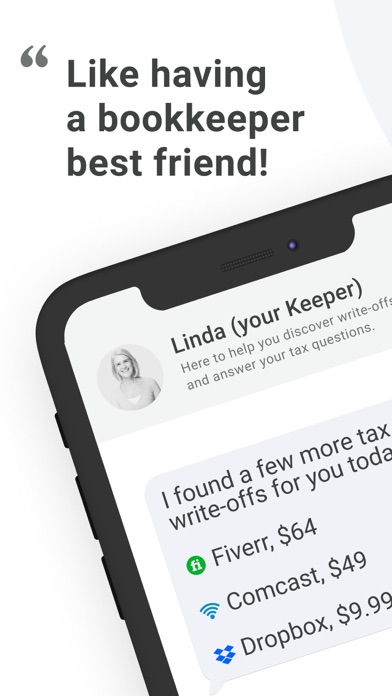

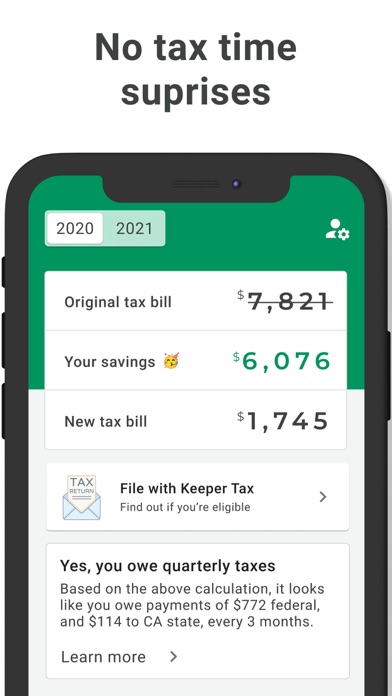

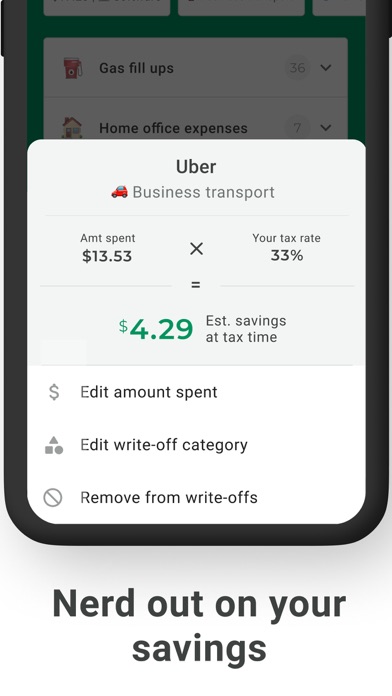

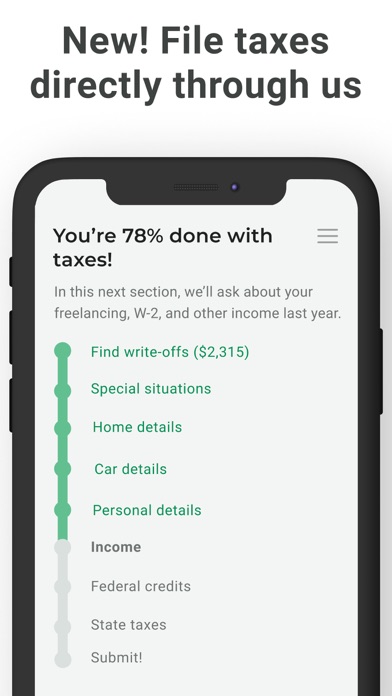

Keeper Tax helps people with 1099 income discover their tax write-offs. ● For self-employed freelancers & contractors ● Automatically links to your cards or bank ● Just reply to texts from your "Keeper" ● Also scans your past expenses ● Bank level security ● At tax time export or file directly through us Whether you're a small business owner, self-employed digital freelancer, or independent contractor - you'll get matched with a professional bookkeeper that knows your line of work and finds you write-offs most people miss. Linking a card or bank is as easy as logging in online. We use SSL 256-bit encryption to protect your data. Once you link card or bank, your bookkeeper texts you once per day with a list of potential write-offs - all you have to do is reply. If you hadn't been tracking your receipts earlier this year (even last year!), we can still scan you card and bank statements for tax deductible expenses. Keeper Tax is secured using SSL 256-bit encryption—the same security protocol that banks use - to ensure that your sensitive personal information is fully encrypted and securely stored. Keeper Tax does not store your online banking credentials, and we do not sell your information to anyone. Easily export a cleaned and categorized spreadsheet of your write-offs, or just file Federal & State directly through Keeper Tax for an additional fee ($89). -------------------------------------------- CATCH EASY-TO-MISS TAX WRITE-OFFS: ● Gas fill ups ● Phone bills ● Work supplies ● Home office expenses ● Meals with clients ● Education expenses ● Car maintenance ● Advertising expenses ● Website hosting fees ● Business travel ● Conference fees ● Contractor expenses ● Parking fees ● Licensing expenses ● Bank fees SUBSCRIPTION BENEFITS • An assigned bookkeeper will text you when they find write-offs • Review your write-offs in the app SUBSCRIPTION INFORMATION • In the app, you will be prompted to subscribe for $16 per month. • The subscription includes a 14 day free trial for new users. Cancel anytime. • After confirming your purchase, you will be charged through a credit card. • Your subscription will be automatically renewed unless you cancel at least 24 hours before the end of the subscription period. • You can manage your subscription by going to the Settings tab in the Keeper Tax app. EXPORT INFORMATION • In the app, you can purchase the export feature for a one-time fee of $39.99. • After the export feature has been purchased, you can export your write-offs in CSV format at any time. • The CSV file will be emailed to you. TERMS OF USE: https://www.keepertax.com/terms PRIVACY POLICY: https://www.keepertax.com/privacy