87 votes - Finance - First release: 2019-04-21T07:43:21Z

Screenshots

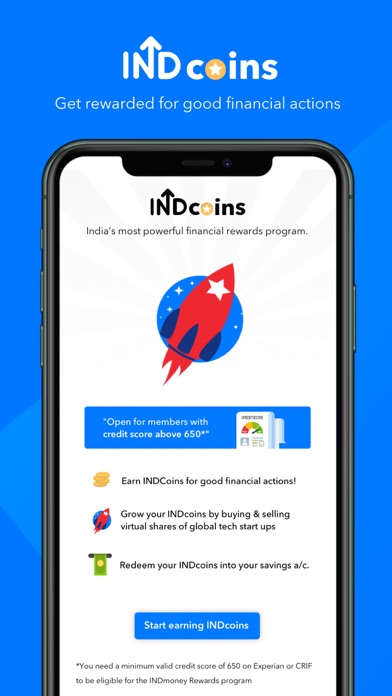

Description - 4+

INDmoney is a Super money app that brings all your money into one app. It enables you to track, invest, save & grow your net worth by automatically bringing your entire financial life across investments, loans, credit cards, taxes, in an easy, fast & secure way. **** Track mutual funds for free - Automatically import and track funds in a single click from across brokers & advisors like Groww, Zerodha Coin, ETmoney, PayTM money, CAMS, Karvy, etc. - Auto-generate your Combined Account Statement (CAS) for mutual funds - Compare mutual funds performance in your portfolio against category benchmarks - Switch your regular funds to direct mutual funds & earn upto 1.5% extra for free **** Track your stock portfolio for free - Auto import shares & stock portfolio across brokers such as Zerodha, Upstox, HDFC securities, ICICI direct etc., and NSE Direct or CDSL/NSDL statements - Track daily share price movement of your stocks such as Reliance, HDFC, TCS, Infosys, ICICI, ITC, etc. - Get stock advisory & recommendations for buy, sell & hold, and real time alerts for your portfolio and the BSE, NSE market **** Track your net worth across investments & loans for FREE - Public Provident Fund - Employee Provident Fund (EPF) - Portfolio management services (PMS) - National Pension Scheme (NPS) - Real estate - Bonds - Government, Corporate, Sovereign Gold Bonds, etc. - Fixed deposits (FD) - Recurring deposits, Maturity dates - All Mutual funds - Regular, Direct, ELSS, Equity, Debt, Hybrid, etc. - Indian Stocks - BSE, NSE - Bank Savings account - Loans - Home, Personal, Car, Education, etc. - Credit cards **** INDmoney is completely secure - SEBI registered entity - Member of BSE star platform - Strict data security policies & encryption - Securely hosted on AWS Mumbai (Amazon). - Biometric on the app with OTP access. Family control **** INDmoney also helps you track your loans, compare and choose new home loans, loans against your investments, personal loans etc from Banks & NBFC’s in India - Free credit score, credit card & loans tracking from Experian & CRIF **** With INDmoney, you can invest in the largest catalogue of investment options such as - Commission free direct mutual funds from all leading AMCs such as ICICI prudential, HDFC, NIPPON India, Axis, PPFAS, Aditya Birla, Mirae, DSP mutual funds etc. - Direct Mutual Funds across categories such as debt, equity, hybrid & low cap, mid cap, large cap, arbitrage & tax saving funds through lump sum or systematic investments plan (SIP) - Best fixed deposit schemes (FD) from Bajaj Finance, HDFC etc. with credit ratings and free risk analysis - get high interest rates - Stocks through portfolio management services Gold bonds, tax free bonds, government, RBI & corporate bonds etc. with credit rating, free risk analysis etc. - Buy & Sell NASDAQ and NYSE listed US stocks such as Facebook, Google, Tesla, Netflix, Amazon, Apple etc, & ETFs to get a hyper growth portfolio and diversification. Free US stock account, fractional investing & zero commission. **** Financial analysis and news - Experts briefs on annual and quarterly reports from listed companies - Stock Market news and its impact on your portfolio - Daily & weekly portfolio analysis & recommendations **** Prime membership subscribers get access to - Access to personalized AI driven recommendations & advisory services - Family office with dedicated family office manager & tax advisor - Family dashboard with deep analytics & custom reports - Tax, retirement, wealth planning & preservation services - Access to INDmoney analyses for Buy-Sell-Hold recommendations and Return/Risk scores. Please reach out to us for any query or feedback at [email protected]