215 votes - Finance - First release: 2018-11-29T08:22:20Z

Screenshots

Description - 4+

We strive to reinvent how you generate wealth.

Take advantage of alternative asset investments with opportunities exclusive to Yieldstreet. Our investments leverage proven asset classes with an investment philosophy designed to bring you offerings previously available to only hedge funds, institutions and the 1%.

Our transparent approach to wealth creation allows investors direct access to alternative investments.

The numbers that matter to you:

• Over $1.5B has been invested on Yieldstreet

• Returned $890M+ in principal and interest

• 149 fully repaid deals already

• 11.29% net IRR

Data as of April 26, 2021

The internal rate of return ("IRR") represents an average net realized IRR with respect to all matured investments weighted by the investment size of each individual investment, made by private investment vehicles managed by YieldStreet Management, LLC from July 1, 2015, after deduction of management fees and all other expenses charged to investments.

Realize your next level with Yieldstreet:

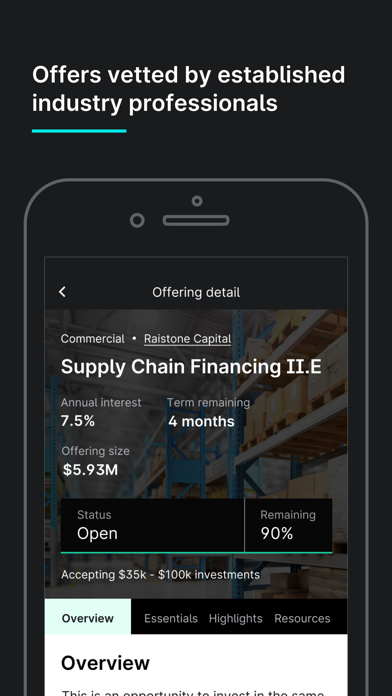

Individual offerings

Take advantage of individual alternative asset classes with offerings exclusive to Yieldstreet in Art, Commercial, Consumer, Legal, Marine and Real estate. Investment minimums start at $1k for Short Term Notes and the Yieldstreet Prism Fund.

Yieldstreet Prism Fund

The Yieldstreet Prism Fund is an income-generating product that can potentially help to further diversify your investment portfolio. With just a single allocation, the Fund allows you to invest across multiple asset classes simultaneously. As of November, the Fund has holdings in six asset classes: Art, Commercial, Consumer, Legal, and Real Estate, and is also invested in Corporate preferred bonds.

The Yieldstreet Prism Fund is open to all investors and the minimum investment is $1,000.

Yieldstreet Wallet

Keep the cash you intend to invest in our FDIC-insured Wallet.

IRAs

Open a Yieldstreet IRA (Traditional and Roth) to take advantage of seamless tax-efficient investing on the Yieldstreet platform.

**Please Note: The Yieldstreet Prism Fund is open to all investors. However, due to SEC regulations, other Yieldstreet investments are open only to accredited investors.

Ready to invest? Learn more at yieldstreet.com

Questions?

Reach out anytime at [email protected].

**Yieldstreet was named top 50 of Inc. 5000 Fastest Growing Companies in the US for 2 consecutive years and ranked 5th fastest growing company to the Crain’s 2020 Fast 50.

DISCLAIMER

Yieldstreet Management, LLC is an SEC registered investment adviser. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Past performance is not a guarantee of future results. Before investing, consider your investment objectives and Yieldstreet's charges and expenses. Not an offer, solicitation of an offer, or advice to buy or sell securities. All images and return figures shown are for illustrative purposes only, and are not actual customer or model returns. Visit Yieldstreet.com for more information.

For the avoidance of doubt, the Yieldstreet Prism Fund (the “Fund”) is a non-diversified closed-end fund for purposes of the Investment Company Act of 1940, as amended (“40 Act”), and is therefore not a 40 Act “diversified” product.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Yieldstreet Prism Fund before investing. The prospectus for the Yieldstreet Prism Fund contains this and other information about the Fund and can be obtained by emailing [email protected] or by referring to www.yieldstreetprismfund.com. The prospectus should be read carefully before investing in the Fund.

Investments in the Fund are not bank deposits (and thus not insured by the FDIC or by any other federal governmental agency) and are not guaranteed by Yieldstreet or any other party.

The Fund is not offered for sale in Nebraska, North Dakota at this time.