4 votes - Finance - First release: 2018-07-06T01:50:10Z

Screenshots

Description - 4+

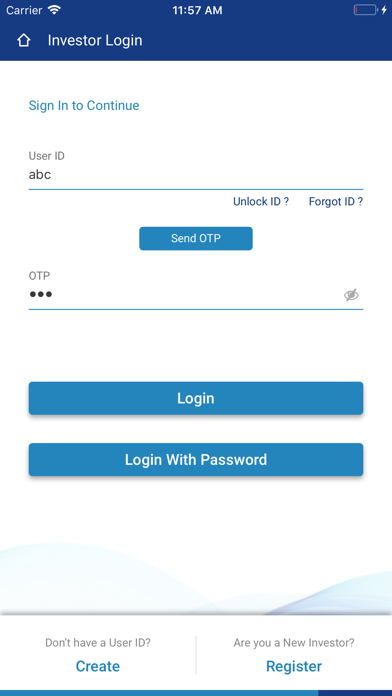

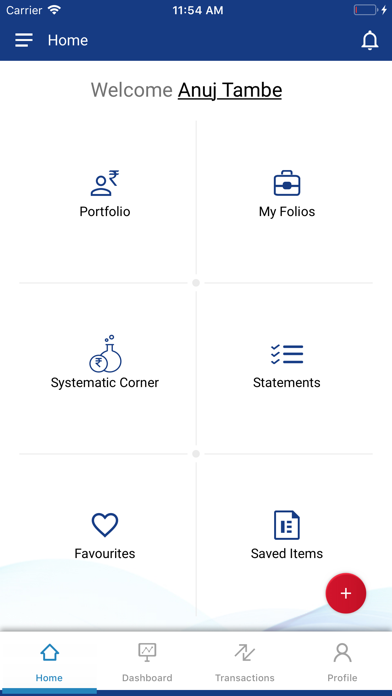

An Official Mobile App for Investors of HDFC Mutual Fund. It is a quick, convenient and efficient platform to make mutual fund investments in various categories like Equity, Debt, Liquid, ELSS, Hybrid, Gold, etc. Be it a one-time purchase or a systematic investment plan (SIP), HDFC MFOnline Investors App has made investing in mutual funds extremely easy. With paperless on-boarding, easy login and one-view dashboard you can track HDFC MF investments on the go. To further improve your investment experience we have features like E-Cart, UPI based payment option and One Time Mandate Registration. If you are new to mutual fund investing, HDFC MFOnline is just the platform for you! You can invest in different types of mutual funds and its various categories like Large cap, Mid cap, Small cap, Multi cap, Flexi cap, Tax Saving (ELSS), Liquid, Overnight, Hybrid, Debt, Gold, etc. With such a variety of schemes available to invest in you can aim for asset allocation and build a well-diversified portfolio. You can seamlessly initiate Purchase, Switch or SIP transaction through the app. You can also invest in NFOs (New Fund Offer) of HDFC Mutual Fund through the app. With so many schemes available to invest in you can aim to diversify your portfolio. There’s more to what we offer on HDFC MFOnline Investors App. If you haven’t downloaded it yet, here’s why you should. 1. Hassle free Registration: With E-KYC & Aadhaar based KYC you can complete your registration process in a few minutes. 2. Easy Login: HDFC mutual fund login is simple and requires minimal steps. Quickly set a 4-digit MPIN and authenticate via OTP to access your investments on the go. 3. One-View Dashboard: Get a holistic understanding of your investment and its performance across folios in a single view. 4. Favorite Section: Create your Mutual Fund wish list by adding the most frequent or preferred investment like ELSS (Equity Linked Savings Scheme) using the Favorites section. This will help you keep a quick check on its performance and invest/re-invest in a few clicks. 5. Multiple Payment Options: In addition to Net Banking, you can now make payment via UPI. You can also register a One Time Mandate for your investments. 6. Schedule Transactions: To manage your investments efficiently utilize the Schedule Transaction feature. It allows you to schedule Purchase, Switch and Redemption transactions in advance as per your convenience. 7. E-CART: Utilize the E-Cart option to make a quick purchase. You can make a single payment for all the schemes that you want to invest in. 8. Instant Redemption: Instant Redemption is a facility which allows you to place a redemption request in Liquid scheme and have the amount credited into your registered bank account instantly (Refer T&C on website). 9. Calculators: Estimate your monthly investment corpus using the sip calculator online. You can also make goal based investments with the help of mutual fund calculator online. 10. SIP Pause: You can utilize the SIP Pause Option to temporarily stop your SIP for a few months. 11. Service Requests: You can initiate service requests like Change of Bank Details, Contact Update, etc. online through HDFC Mutual Fund Mobile App. We make constant efforts to bring to you best in class experience of transacting to make your mutual fund investing journey fun and interesting. HDFC Mutual Fund Mobile App will be of great help to investors opting for direct as well as regular plans. Download the App Now and get started! You can also visit https://www.hdfcfund.com/ or call us on 1800 3010 6767 / 1800 419 7676 Timing: 9am to 6pm from Monday to Friday; 9am to 1pm on Saturday You can write to us on [email protected] MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.