4479 votes - Finance - First release: 2017-11-15T16:16:43Z

Screenshots

Description - 4+

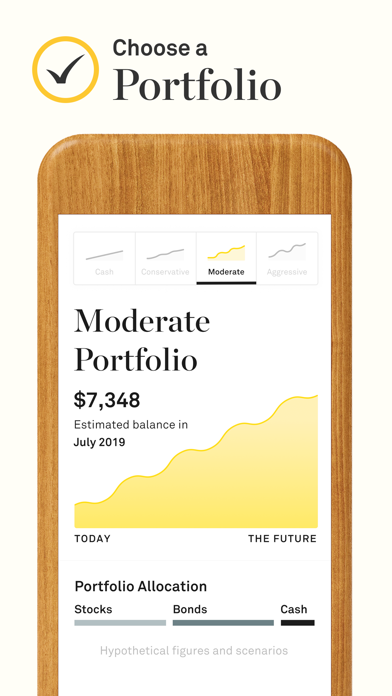

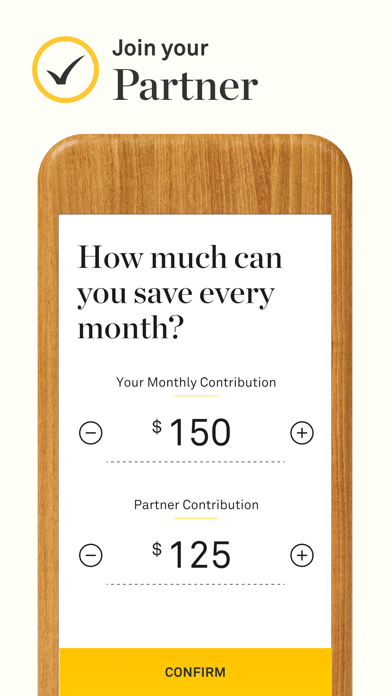

Save money for financial goals with Twine, the first saving and investing app built for two! Download today to start saving and investing for your financial future together. Working on your shared goals through easy saving & investing has never been easier. From a wedding to a down payment, save up for the milestones that matter and get there together. -- HOW TWINE WORKS -- 1. Pick your financial goal, whether it’s saving for a house, saving for retirement, saving for a wedding, or just saving for vacation. 2. Select an investment portfolio (or save in cash) 3. Connect your bank to start saving money in Twine and making progress on your goals 4. Once your new account is open, you can easily track the progress of your shared goals from the app, without multiple tools and spreadsheets. -- TOP FEATURES -- 1. With the Twine app, you have the option to choose unlimited goals. Choose individual or shared. 2. Gain smart recommendations from the app tailored to your financial goals. 3. Track your goal progress and manage deposits, all from one intuitive dashboard. 4. Set and forget using automatic deposits from the app. We have you covered. 5. Enjoy bank-level security that keeps your personal information and accounts safe. Twine helps you to make the financial decisions that are right for you and your partner. No matter the goal, our trusted and reliable service makes the process of saving up or investing money simpler than ever so you can focus on your life’s journey! * Twine is backed by John Hancock and 150 years of stability and expertise.* -- DISCLAIMER -- John Hancock Personal Financial Services, LLC (“JHPFS”) is an SEC-registered investment adviser. Clearing, custody and other brokerage services are provided by Apex Clearing Corporation (“Apex”). As with any investment account, your money is not FDIC insured or bank guaranteed. This means we can’t guarantee you won’t lose money (including the money you start with). The JHPFS fee does not include the expenses of the underlying investments in your account. Any projected investment outcomes or goal achievement dates are hypothetical in nature, provided for educational purposes only, are not intended to serve as the primary or sole basis for investment decisions, and are not guarantees of future results. Please see full disclosure for more information. By downloading our app you accept our privacy policy located here: https://www.johnhancock.com/privacysecurity.html