75942 votes - Finance - First release: 2017-04-10T22:13:26Z

Screenshots

Description - 4+

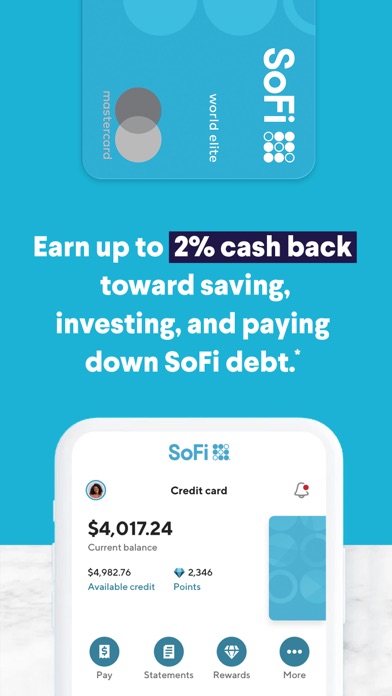

Trade stocks, cryptocurrency, ETFs, and participate in upcoming IPOs at the IPO price with SoFi Invest®. Pay no account fees and earn cash back rewards when you spend on your favorite brands with a SoFi Money® debit card. ---Invest: Stocks, crypto, and automated investing • No commissions & no account minimums to invest in stocks • Get in on the IPO action at IPO prices • Buy a piece of popular stocks starting at $1 with fractional shares • Trade Bitcoin ---SoFi Money: save, spend, and earn—all in one product. • Pay zero account fees. No annual, overdraft, or other account fees.* *We work hard to give you cash back rewards and charge no account fees. With that in mind, our interest rate and fee structure is subject to change at any time. See our terms and conditions at sofi.com/legal. ---Loans: You can check your rates and apply all online or in our app. • Personal loans for what you need—and when you need them. Fund a home renovation or consolidate credit card debt. • SoFi is the leading student loan refinancing provider. You can save thousands when you refinance your student loans. DISCLOSURE Investments products: ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE *No purchase necessary. Probability of customer receiving $1,000 is 0.028%. See full terms and conditions at https://www.sofi.com/invest/clawpromotion/rules Investing in an Initial Public Offering (IPO) involves substantial risk, including the risk of loss. For a comprehensive discussion of these risks please refer to SoFi Securities’ IPO Risk Disclosure Statement at sofi.com/iporisk. SoFi Money® is a cash management account, which is a brokerage product, offered by SoFi Securities LLC. Member FINRA/SIPC. Neither SoFi nor nor its affiliates is a bank. SoFi loans are originated by SoFi Lending Corp. and not all products are available in all states. Additional terms, conditions, and state restrictions apply; https://www.sofi.com/eligibility for details. Licensed by the DFPI, CFL#6054612. NMLS#1121636 (nmlsconsumeraccess.org). We offer no guarantee that specific investments and strategies will be suitable or profitable. SoFi Relay, financial planning and automated investing via SoFi Wealth LLC, a registered investment advisor. Brokerage services via SoFi Securities LLC, registered broker dealer and member FINRA/SIPC. Risk is a natural part of investing—and crypto, due to its volatility, carries a higher degree of it. FINRA, the SEC, and the CFPB have issued public advisories concerning this. SoFi Crypto via SoFi Digital Assets, LLC, a FinCEN registered Money Service Business. SoFi isn’t endorsing, and is not affiliated with the brands or companies displayed. Active investing via SoFi Securities LLC, member FINRA/SIPC, IN19-1324 Stock Bits is a brand name of the fractional trading program offered by SoFi Securities LLC. You are granting SoFi Securities discretion to determine the time and price of the trade. Fractional trades will be executed in our next trading window. The execution price may be higher or lower than it was at the time the order was placed. We’ve partnered with Allpoint to provide you with ATM access at any of the 55,000+ ATMs within the Allpoint network. You will not be charged a fee when using an in-network ATM, however, third party fees incurred when using out-of-network ATMs are not subject to reimbursement. SoFi’s ATM policies are subject to change at our discretion at any time. The SoFi Money® World Debit Mastercard® is issued by The Bancorp Bank pursuant to license by Mastercard International Incorporated and can be used everywhere Mastercard is accepted. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.*See Rewards Details at SoFi.com/card/rewards