56671 votes - Finance - First release: 2017-06-14T18:33:46Z

Screenshots

Description - 4+

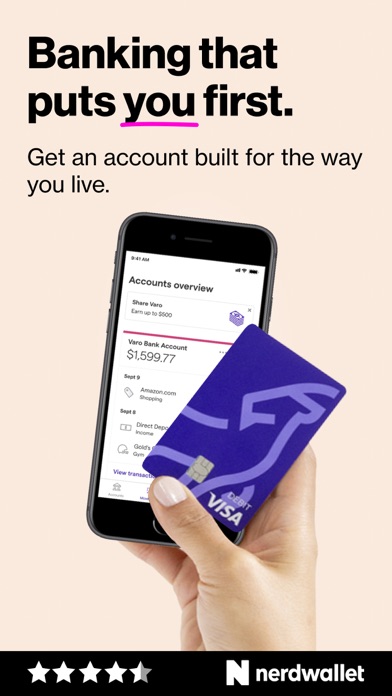

This app is will soon be discontinued. Varo has a brand new app and a new contactless debit card! If you’re new to Varo, search for Varo Bank and download the new app. If you’re an existing customer, stay tuned for an email from us on how to seamlessly transition to the new app and card!