73322 votes - Finance - First release: 2016-06-02T02:03:58Z

Screenshots

Description - 4+

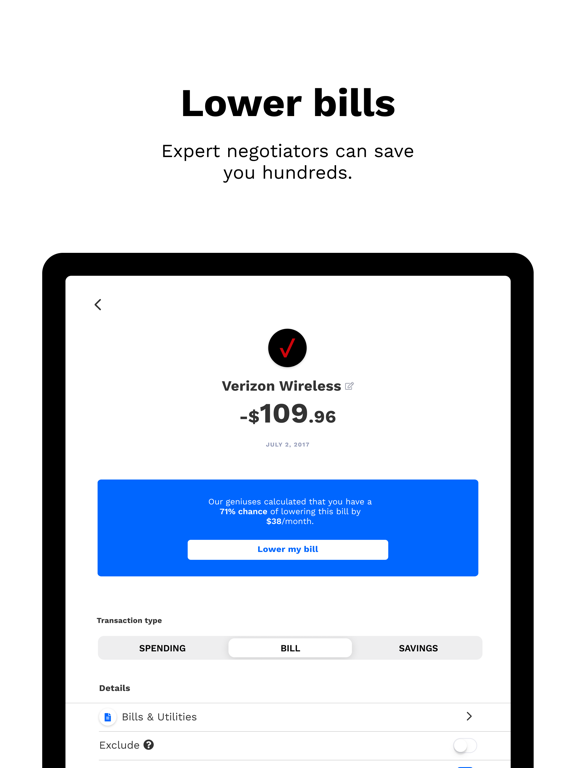

HOME FOR YOUR MONEY Mobile banking, saving, budgeting and investing — in one place. Plus human experts at your fingertips. Join over 5 million users who trust Albert to spend, save, and invest smarter. MOBILE BANKING Automatic saving and investing right from your paycheck. Plus, get your paycheck up to 2 days early when you set up direct deposit. Spend money with your Albert debit card and withdraw fee-free from over 55,000 Allpoint ATMs. ADVANCE CASH, INSTANTLY Avoid overdrafts. Albert can spot you up to $100 from your next paycheck. No late fees in minutes. No interest. No credit check. SAVE SMARTER Albert tracks your income and spending to find dollars you can safely save, automatically. Earn cash bonuses for every dollar in Savings and withdraw your funds at any time. INVEST YOUR CASH Grow your money with Genius. Trade stocks and themes. Or let Albert create your custom, diversified portfolio, built for your financial goals. MANAGE YOUR MONEY Budget and save automatically. Albert creates your personalized budget, identifies missing savings, and helps you lower your bills. GENIUS ADVICE Albert Genius makes your money smarter, no matter how much you have. Get personalized, honest money advice from a team of finance experts, or "geniuses", in real time. Genius combines powerful technology with unique insights to help you make better choices. Questions about investment plans? Budgeting for your bills? Paying off credit cards? Send a text, and they'll get to work. Some topics Genius can help with: Budgeting • Savings • Credit cards • Insurance • Investments • Debt • Student loans • Buying a home ALWAYS WORKING FOR YOU Albert is always working in the background to help you budget and save. Get smart alerts about your money in real time and put an end to financial surprises, so you stay in control. Albert finds subscriptions you forgot about and can help you lower your bills by up to $250. PRAISE FROM THE PRESS ⁃ “The Albert app provides a personalized savings account and can look at car insurance policies and credit cards to find better deals. Banks are racing to catch up with such digital advances." — NEW YORK TIMES ⁃ "Dying for an app that takes the math out of budgeting? Albert would be the best choice for you." — FORBES ⁃ "Albert offers a simple way to track your finances as well as personalized recommendations aimed at boosting your overall financial standing." — TechCrunch SECURITY • Albert uses cutting-edge technology to protect your most sensitive information. • Albert Cash and Albert Savings account are FDIC-insured. Should anything happen to the member bank or company holding your savings, you'll be insured for up to $250,000 of your money in the account. • Funds in your Albert Investments account are SIPC-protected. This is a more limited protection against the loss of securities and cash held at a member firm up to $500,000 in the event the firm fails. This does not protect the securities you own from going down in value if the market changes. DISCLOSURES The Albert app facilitates banking services through Sutton Bank, Member FDIC. The Albert Mastercard® debit card is issued by Sutton Bank, Member FDIC, pursuant to a license by Mastercard International. Albert Investments, LLC is a Registered Investment Advisor. Albert can only offer investment services to clients where Albert and its representatives are properly licensed. The content posted is solely to inform. Investments are risky: you could lose money, and past performance is no guarantee of future returns. Albert is only available to U.S. residents who are 18+. For more information, see our Form ADV Part II and our Terms of Use at albert.com.